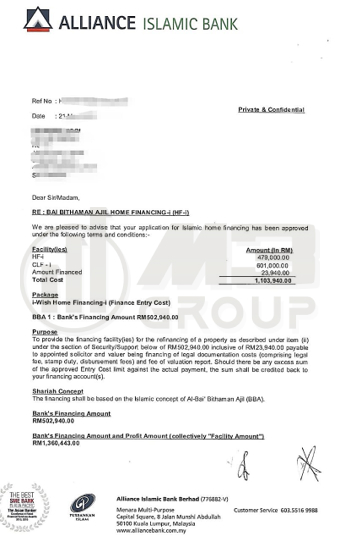

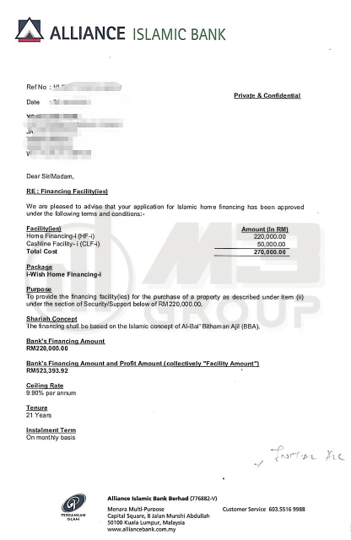

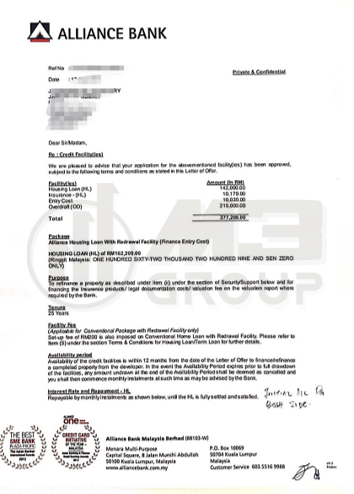

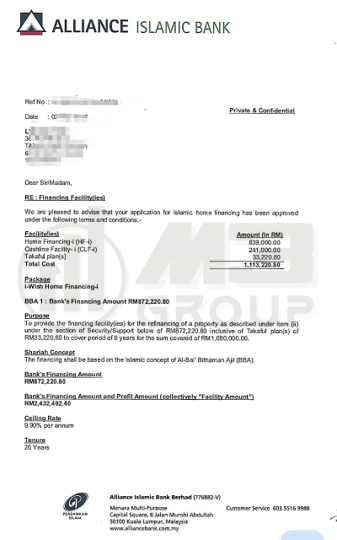

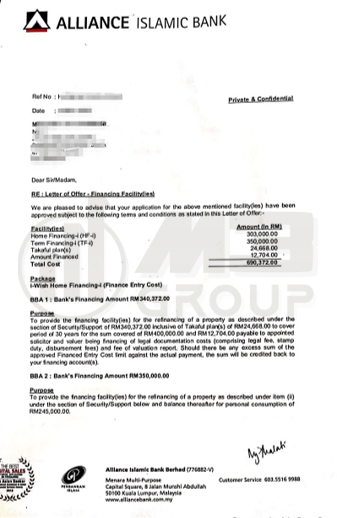

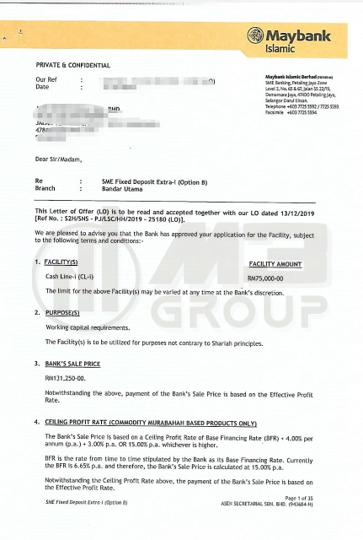

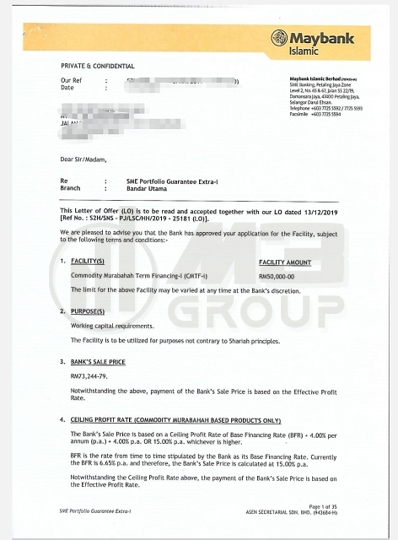

Loan approval rate as high as 99%

Subject to your application, normally will receive notification within 7 days after submitting the document, t&c apply.

We know all banks’ flavour very well, different fields will have their own suitable banks, we will evaluate your credit report and advise you the best solution.

Absolutely not. We provide free consultancy. Even without proceed further, we will give you the best advice on how to build your profile for future.

In this age of advanced network, all can be done online including if you are from other state, even if you want to submit documents, you do not need to go to bank in person as well.

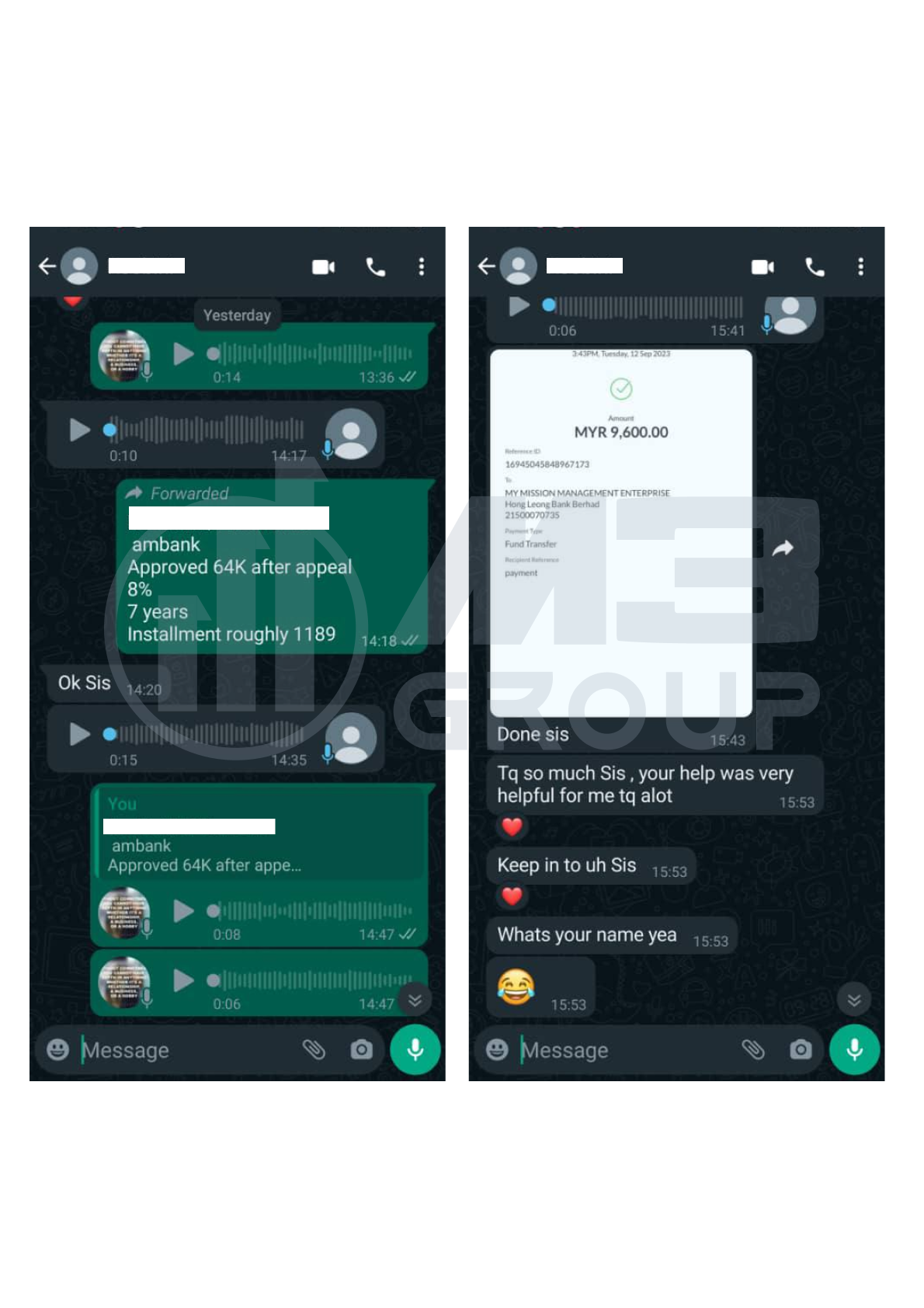

Can. We will review your case that has been rejected before, and then give you the best advice to increase the approval rate, at least at 99%.

Our first priority is to help customers to achieve their dream home and reduce your troubles. We will also give some advice to let customers know how to utilise property to generate passive income.